What’s new with our digital banking?

No need to worry – the convenient online and mobile banking features you’re used to aren’t going away! As part of Westfield Bank’s efforts to make your digital banking experience better, we’re bringing you a more streamlined, modern, and customer-focused interface. Your favorite digital banking tools – whether you’re using a web browser or a mobile device – are now enhanced for quicker access and easier use.

Update available for your Westfield Bank mobile app

To make your mobile banking experience better, we have made backend functionality and user interface improvements. Two important convenience enhancements include a biometrics login redesign and a new balances widget.

Install the latest version, iMobile 11, of your My Westfield Bank mobile app now, for both Apple iOS and Google Android.

Biometric app login redesign

We’ve simplified biometrics login enrollment. Based on your device capability, you can now enroll and access your account with Face ID or fingerprint at sign-on.

What to expect

All of our mobile banking customers will need to re-enroll in biometrics with the upgrade.

When you login to mobile banking for the first after you upgrade to iMobile 11, you will receive an on-screen prompt when you enter your password to enable biometric log-in (Face ID or Fingerprint). Please note: The type of biometric option presented will be based on what your device supports.

To enable

- Simply select Enable.

- You may be required to login with your credentials (User ID/Password).

- After successful login, you will be successfully enrolled.

Preventing biometrics login

If you would like to prevent biometrics logins, when you receive the on-screen prompt, simply select Don’t Enable.

Balances widget

A new Balance widget is available for set up on both iOS and Android allowing you access to your account balances without having to log into the app2.

To enable

- Log in to mobile banking.

- Access your profile.

- Select Banking services and then Manage balances.

- Follow the on-screen prompts to enable balances for your preferred accounts.

2Currently the Balances widget is not working on iOS 16. The widget works on prior iOS versions.

Modernizing and optimizing digital banking

Here are the enhancements you’ll see on all devices:

- Redesigned, larger font for easier-to-read text throughout the platform

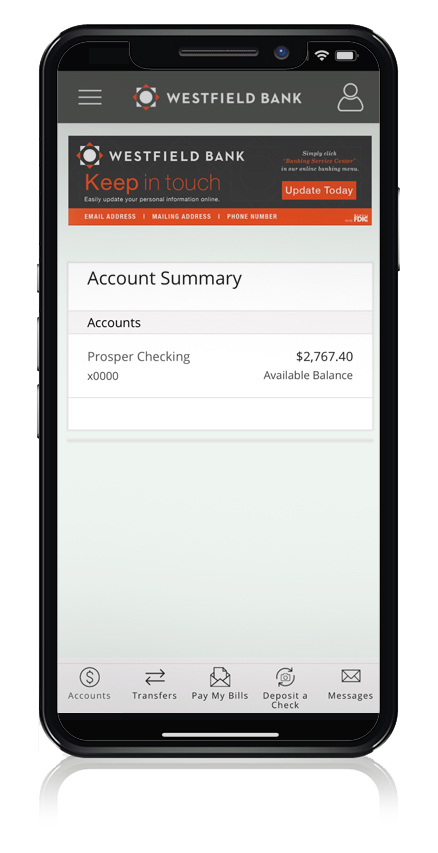

- We’ve removed the home tiles, to have a simplified account summary page once you’re logged in with quick, virtual access to manage all your accounts

- Improved account action with streamlined navigation

- Upgraded account activity page displaying credit amounts in green so you can identify them quickly

- A new profile menu to access your banking services center and adjust your personal and account settings easily

- Revamped transfers page with scheduled and historical activity all on one page

Here are the enhancements you’ll see on your mobile device:

- Improved hamburger menu featuring the major digital banking functionalities, in icon format, for convenience and ease

- New bottom navigation bar, giving you easy access to commonly used tools with just one click

- Prolonged battery life and easier viewing thanks to the new dark-mode theme option

Frequently asked questions

Is biometrics login available for Apple iOS and Google Android devices.

Yes. Biometrics log in is available for both iOS and Android. Please note, Google has dropped support for Face ID on some of their Pixel devices. We support the native Android OS/Google face ID setup and security standards and will activate Face ID for these devices when Google releases them.

If I don’t install the iMobile 11, today when will the application upgrade?

If you do not initiate the update yourself, the latest version of the application will automatically update on April 18th.

What if I ignored the initial prompt for biometric login and want to enable?

You can enable and manage your biometrics settings by accessing your profile, select Banking services, Manage Biometrics, then selecting Biometrics enrollment. Follow the on-screen prompts.

I enrolled in biometric login initially, and now I would like to turn off the feature. How do I do that?

You can turn off the toggle on the log-in page, which will prompt you to confirm turning off biometrics. Once you confirm, you will be asked to sign into the app to remove the device from the Biometrics Device list. You can do that by accessing your profile, select Banking services, Manage Biometrics. Select the ‘x’ next to your device, then confirming deletion will remove the biometrics enrollment.

When will the changes go live?

The new look and feel will go live on March 21, 2023.

Can I switch back to the old design?

This updated design will be the only option for online and mobile banking. The theme switcher tool will remain available, allowing you to choose between your preference of dark or light mode.

Will my process for logging in to online or mobile banking change?

You will see no changes to the login page. If you have previously bookmarked the URL for our online banking login, you may need to update your bookmark on March 21st. If you already have our mobile app downloaded, your app will automatically update on March 21st when the change goes live. You do not need to re-download the app in order to access the mobile banking updates.

Biometric login will remain available for secure login.

Are any consumer banking features going away?

You will continue to enjoy all the same features and functionalities you are used to including, reviewing your account balances, depositing checks, managing your accounts, online bill pay, and electronic fund transfers.

Are any business banking features going away?

Similar to our consumer customers, business customers will continue to enjoy all the same features and functionalities you are used to including, managing your ACH collections and sends, positive pay validation, and initiation, approval, or release of wire transfers.