Frequently asked questions

How often can I access my funds?

You can make unlimited program withdrawals using the ICS demand option.

Who has custody of my funds?

Funds placed through ICS and CDARS are deposited only in FDIC-insured institutions. We act as custodian for your ICS and CDARS deposits, and BNY Mellon acts as subcustodian for the deposits.

Unique to CDARS, you as a depositor can obtain a confirmation of records maintained by BNY Mellon as subcustodian to reconcile those records with the statements received from us. At any time, as often as desired, you as a depositor can obtain a certified statement from BNY Mellon that confirms the exact amount of your CDs, including principal balance and accrued interest, for each FDIC-insured institution that issues a CD through CDARS.

You can submit a request for the certified statement, along with BNY Mellon's processing fee, through us. BNY Mellon will send the certified statement directly to you or to another party designated by you, such as an auditor.

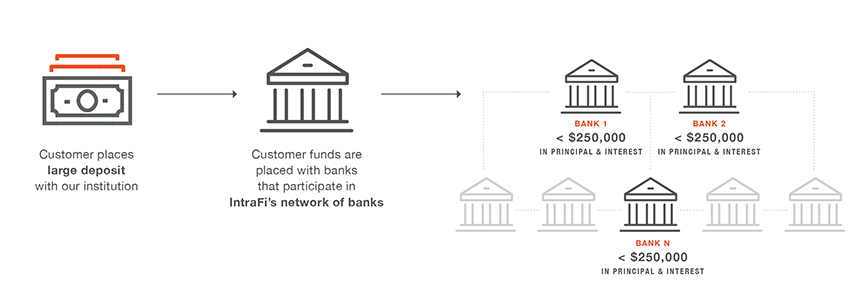

Who provides the additional FDIC insurance when my funds are placed using IntraFi Network Deposits?

Through CDARS and ICS, funds are placed with other institutions participating in IntraFi's network, and those network members provide you with access to FDIC insurance coverage on deposits at those banks. Working directly with just our bank, you can access coverage through many.

How can my funds be used locally if my accounts are issued by financial institutions across the country?

When we exchange deposits with other institutions that use IntraFi Network Deposits on a dollar-for-dollar basis, the same amount of funds placed through the network returns to us. As a result, the total amount of your original deposit can remain with our bank and be used for local lending.[2]

Is my account information safe?

You work directly with just us—the bank you know and trust. As always, your confidential information remains protected.