Plan now, save later

With the new year and holiday season on the horizon, taxes might not be on the top of your mind right now. But with careful planning before the end of the year, you can set yourself up for savings when it’s time to pay taxes in the spring.

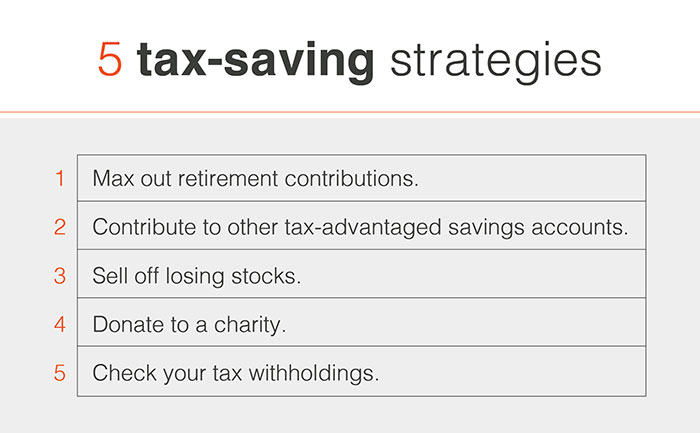

Let’s a take a look at some of the most common tax-saving strategies* you can consider making before 2022 comes to an end:

*Please note, these are general suggestions. Please consult your tax advisor about which strategies are best for your situation.

- Max out retirement contributions. Contributions made to retirement accounts like an IRA (traditional or Roth) or 401(k) will lower your taxable income at the end of the year. Each year, the IRS sets a maximum contribution limit for these accounts. In 2022, the max contribution a worker under the age of 50 can make for a 401(k) is $20,500, with workers 50 and older having the option to contribute an additional $6,500. For IRAs, the limit is $6,000 for workers under 50 and an additional $1,000 is allowed for workers 50 and up. Making the maximum contribution into your retirement is a great way to invest in your future while reducing your taxable income at the end of the calendar year. Even if you can’t contribute the max, any amount you can afford to contribute before the new year will pay off.

- Contribute to other tax-advantaged savings accounts. In addition to making timely contributions to your retirement accounts, the same benefits apply to other savings accounts. Other tax-advantaged accounts include Health Savings Accounts (HAS) and 529 plans (for future college expenses).

- Sell off losing stocks. Have any of your investments had bad luck in 2022? By selling your shares for a loss, while profiting on other investments, the IRS will see that you made less of a profit during the year and therefore reducing what you owe in taxes. Simply put, now’s an ideal time to sell off any bad investments you made in the last year. This strategy is sometimes referred to as tax-loss harvesting

- Donate to a charity. Feeling generous this holiday season? On top of the obvious benefits of donating to a charity, this transaction will also help you save on taxes. When you donate a 501(c)(3) non-profit organization, you can deduct the amount of your donation against your adjusted gross income tax. Always save the receipt from your donation so that you can verify the transaction on your tax return.

- Check your tax withholdings. If you’ve earned income during 2022 from side hustle or stock investments, it’s important that you’ve withheld enough in income taxes. What you owe on this income is supposed to paid at the end of each quarter, but if you haven’t done this, you can avoid the interest that comes with an underpayment penalty by withholding more on any year-end bonuses or on your W-2 form. You can check your tax withholdings at www.usa.gov/check-tax-withholding

Don’t let 2022 come to an end without taking action to save money this spring. With tax season on the horizon, Westfield Bank is proud to be a partner as you pursue your financial goals.