How do I increase my credit score? Six tips to raise your credit

While a good credit score can make it easier to qualify for loans or credit cards – ultimately saving you money – bad credit can limit your opportunities. This is why it’s important to maintain a good credit score and follow tips to increase your credit score when possible.

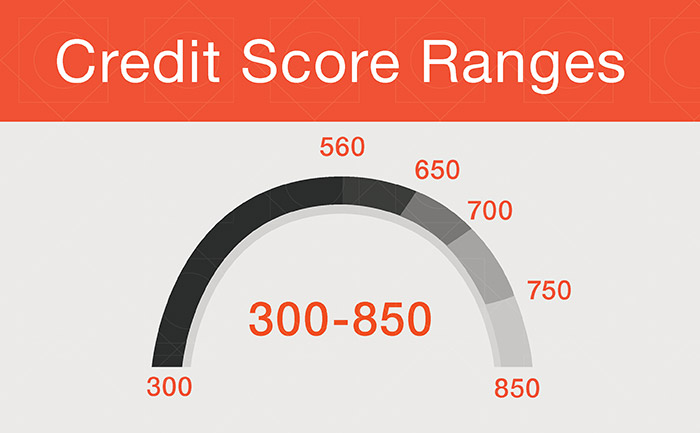

Your credit score is a number between 0 and 850 and is based on how likely you are to repay funds you borrow. The higher the number, the more likely; the lower the number, the less likely you are to repay money you owe. Historically, a credit score of 700 is regarded as a good credit score, while 800 or higher is exceptional. If your credit score isn’t in this range, here are six tips to repair your credit history.

- Pay bills on time

- Make frequent payments

- Keep credit cards open and active

- Increase credit limits

- Dispute errors

- Diversify credit

Pay bills on time

Payment history is the number one driver for your credit score. Paying bills on time helps you improve your score, while paying late could haunt you for up to eight years, contributing to a lower credit score.

TIP: Pay your bills with ease from one convenient platform to manage and track monthly payments for rent or mortgage, internet, utilities, and credit cards. Available through our My Westfield Bank app and online banking, Bill Pay saves you time and gives you peace of mind by making it easier to manage and pay your monthly bills. Change the way you pay your bills and enjoy our services, which empower you to:

- Schedule recurring bill payments

- Set reminders to pay your bills on time

- Search a database of your payees

Log in to your online banking account or your My Westfield Bank app to start using Bill Pay.

Make frequent payments

Multiple, smaller payments throughout the month can assist with increasing your credit score. This approach focuses on the concept of credit utilization, or the percentage of your available credit used. If you can show that you are using your credit more frequently, your credit score will start to move.

Keep credit cards open and active

Having multiple credit cards with comfortable balances based on your income and expenses can aide in improving your credit score. However, those cards must be used and active to count toward your score.

TIP: Set a schedule (e.g. monthly or even annually) to make a transaction on each credit card to ensure that they are open and active.

Increase credit limits

Expanding the limits of your credit shows that you are able to manage greater funds. So when you increase your credit limit, if your balance stays the same and your overall credit utilization will decrease, improving your credit. Contact your credit card company or Westfield Bank to see how they can help.

Dispute errors

Mistakes can happen. However, forgetting to rectify these issues can be detrimental to your credit score. Whenever you find errors, contact your credit card company or Westfield Bank to see how they can help.

Diversify credit

Your credit score reflects more than utilization of credit cards. Any expense with lenders or utilities, as well as loan payments contribute to this score. Ensuring that you diversify your portfolio of credit, or improving your credit mix, will improve your score. To diversify your credit, make sure that you have revolving and installment credit accounts. Both can impact your credit score; however are quite different in borrowing and payment structure.

The most common revolving credit account is a credit card – one that you charge and make variable payments each month. The balance is always changing and there is no particular end date. However, installment credit accounts, like a home or auto loan, have fixed payments and a set balance divided equally into reoccurring payments each month with a particular end date. Multiple accounts within these two categories will ensure that you diversify your portfolio of credit and improve your credit mix.

On your journey to achieve financial freedom, always remember to maintain comfortable levels of credit on your accounts based on your income and expenses. If you ever have questions about this, your portfolio of credit, or banking accounts, contact Westfield Bank for assistance.

Diversify your portfolio of credit today

Westfield bank offers three great options for consumer credit cards with rewards, competitive rates, and travel protection available. Learn more