How to budget after graduation

Whether you’ve recently completed an associate, undergraduate, master’s, or doctoral degree, it’s time to take on new challenges and discover the path before you.

Your life and spending after graduation can be drastically different than what it was while you were studying. For some, this involves making the transition from classes to a full-time job. While this generates money, there are several costs that will inevitably increase as you progress in life. However, these costs do not need to outweigh your income or cause you to live too frugally.

Instead, it’s important to create a monthly budget, which is a recurring detailed plan that includes your income and spending habits to help ensure you spend less than you earn. By practicing financial discipline and creating a budget, you can empower your own financial freedom as you explore and begin your professional career.

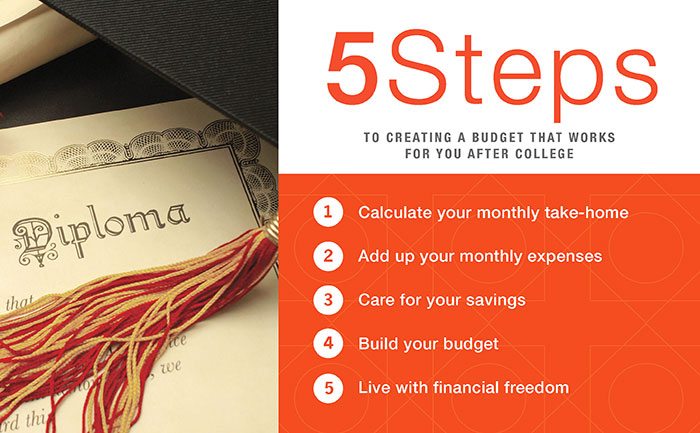

Below are five steps to creating a budget that works for you after graduation.

Step 1: Calculate your monthly take-home

To accurately set your budget, it’s important to start by finding out what exactly your take-home pay is. Your take-home pay can be significantly different than your gross salary. A gross salary is the amount you earn before taxes and deductions, while your take-home pay is the net amount you earn after the deduction of taxes, benefits, and any contributions to retirement you may make from a paycheck.

This can also change based on your actual payment schedule. If you’re paid on a biweekly basis, rather than a monthly basis, you can calculate your earnings by using an easy formula. First, multiply your biweekly take-home pay by 26. This is the number of bi-weekly pay periods in a year. Then, divide the sum by 12 to calculate your monthly take-home pay.

Ultimately, by utilizing your take-home pay and breaking down by months, you can have a clearer picture of how much cash will actually flow into your account.

Step 2: Add up your monthly expenses

There are generally two types of expenses that you can encounter on a monthly basis. The first is fixed expenses. These are expenses that remain the same from month to month. For example, rent or mortgage, insurance, and any debt repayments, like student loans.

The second type is variable expenses. These are expenses that may be one-time or recurring that aren’t the same from month to month. For example, utilities, groceries, and transportation costs.

To build your budget, first add up your fixed expenses. Then, take an average of the variable expenses that you typically have. While these expenses may not be an exact calculation, they can give you an insight of how much is typically spent in a month for variable expenses. Lastly, add your fixed and variable expenses together for a total result.

Step 3: Care for your savings

Once you’ve subtracted your expenses from your total take-home income, ideally, you’ll have more money to work with. Generally, it’s recommended that 50 percent of your monthly take-home pay is used for fixed expenses, while 30 percent is used for variable expenses and lifestyle spending. So, what can you do with the remaining 20 percent?

Perhaps the most beneficial way to use the remaining 20 percent of your monthly take-home pay is to create an emergency fund with a savings account. As you build your wealth, it’s critical to have money on-hand just in case unexpected expenses arise, like repairs to your car. Savings accounts allow you to deposit money and earn interest. Additionally, over time, this can help grow your wealth and be used as you look to take life’s next step, like purchasing a home.

Depending on your situation, it may also be a good time to begin contributing to an IRA. Want to learn more? Click here.

Step 4: Build your budget

Depending on your unique situation, you may need to customize your budget. For example, the cost of living in your current situation may require more than or less than the recommended 50 percent of your monthly take-home pay. If your fixed expenses are less than the recommended 50 percent, you may consider adding more funds to your savings, or even as spending money. On the contrary, perhaps your fixed expenses are significantly over your take-home pay, so you may trim your spending and savings budget to accommodate.

It’s important to work through the numbers and decide what’s right for you.

Step 5: Live with financial freedom

By establishing a realistic budget that you can comfortably live to, you have provided yourself with financial freedom to make purchases and manage expenses, all while building your savings.

Simplify money management

At Westfield Bank, we offer industry-leading rates, truly personalized service, incredible convenience, and the latest in technology, all to help make your banking better. Learn more.