M&A vs. organic growth: what is best for your firm?

When it comes to expanding your financial advisory practice, there are two paths to follow – organic growth or mergers and acquisition (M&A). Both have the power to move your business to the next level, but which approach is right for your firm? Often, a mix of both is appropriate. To determine if organic growth or M&A is best, you must assess your goals, priorities, and capacity.

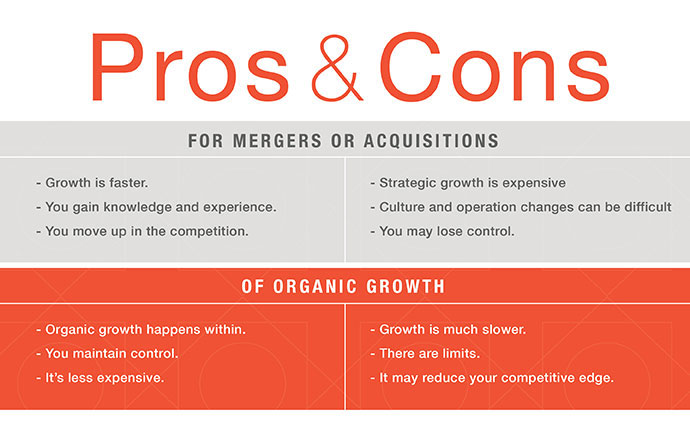

Pros & cons of organic growth

Organic growth is a strategy focused on writing new business. You control the areas to focus on, tactics to get more production out of your staff, and perhaps new expansion areas.

- Organic growth happens within. You know your firm inside and out, so you and your team can adapt to internal changes more quickly and easily.

- It’s less expensive. Mergers & acquisitions can be a tough venture – it is often expensive and very competitive. It is much more cost-effective to invest your capital into organic growth.

But organic growth is not without its challenges:

- Slower process. Organic growth takes time, and growth is generally noticeable over a longer period of time

- There are limits. If going the organic route, your growth can’t surpass the capacity of your team and resources

- It may reduce your competitive edge. Growing faster than your competitors keeps you ahead, and the slower pace of organic growth may benefit competitors.

Pros & cons of growth via mergers & acquisitions

M&A is an external approach to improve output and performance by acquiring a new book of business, along with talent, markets, technology, and other capabilities. This approach has its own advantages:

- Faster. The benefits of M&A are almost immediate, including an increase in market share, earnings, and clientele.

- Knowledge and experience advancement. Combining your firm with another comes with the added benefit of their expertise.

- Competitive advantage. Your increased market share and resources will move you ahead of your competitors.

However, there are obstacles to consider:

- Costly. M&A has a significant upfront cost, which may result in your firm accruing debt.

- Complex culture and operational changes. Sudden growth, and integration, requires you and your staff to adapt to new processes and team members.

- You may gain partners. Merging with another practice may mean you bring in new business partners and others to the decision-making table.

The optimal plan for your business depends on your vision for the future. If your aim is to enter a new market, obtain new technology, or eliminate competition, M&A might be the path for you; if you have the capital to invest. If your goal is to improve performance or reduce costs, organic growth allows you to focus your resources internally.