Finding the right account

Savings and checking accounts are common and easy-to-use banking tools. When the right savings account is chosen, it can be used not just to save your money but also to grow your savings. The right checking account can empower you to make daily financial transactions with ease. With so many different account offerings out there, how can you choose the account that’s best for you?

There are several key considerations to keep in mind before opening a savings or checking account, including interest rates, minimum balance and initial deposit requirements, fees, and more. Let’s take a look at what you need to know.

Interest rates

One of the key features of savings and checking accounts is that the money saved in it earns interest over time. In other words, the money you save earns you more money. The interest rate determines how much your money will grow, so this should be a top consideration when selecting a savings account. Since checking accounts are designed for spending, they come with lower interest rates compared to savings accounts.

Some savings accounts have an interest rate of a fraction of one percent while others are two percent or higher. Higher-interest accounts can come with potential drawbacks, such as a high minimum deposit or balance requirements.

Interest rates are typically advertised using APY – annual percentage yield – indicating the percent that your savings will grow by over the course of a year. For example, if you save $1,000 in an account with 2% APY, you will earn $20 after the first year (1000 x .02 = 20).

Minimum balance and initial deposit requirements

In order to open a new account, banks will sometimes require you to deposit a minimum amount of cash up front as well as maintaining a minimum balance at all times. There are plenty of options out there that don’t require either of these, but accounts that earn a higher interest rate are more likely to come with minimum requirements. For example, a savings account may require at least a $500 deposit to open the account and this amount must be maintained at all times going forward to avoid a fee.

Account fees

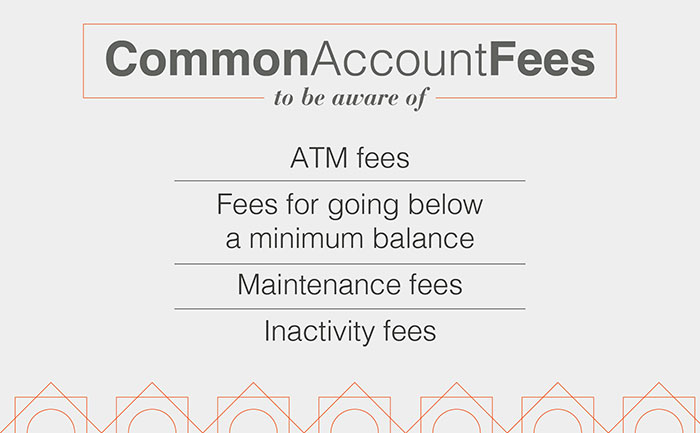

Before opening a new account, you’ll want to be aware of any fees associated with using the account. Common fees include ATM fees, fees for going below a minimum balance, maintenance fees, and inactivity fees.

Ultimately, don’t settle for a savings account that doesn’t grow your money or a checking account that doesn’t make everyday spending easier. Westfield Bank offers account options that fit your personal finance preferences.