Managing your parent’s finances

You might remember a time when your parents gave you an allowance as a child to help teach you about finances, or maybe you recall the time they helped you open your first bank account. As your parents get older, it’s possible that a time will come when it’s your turn to return the favor.

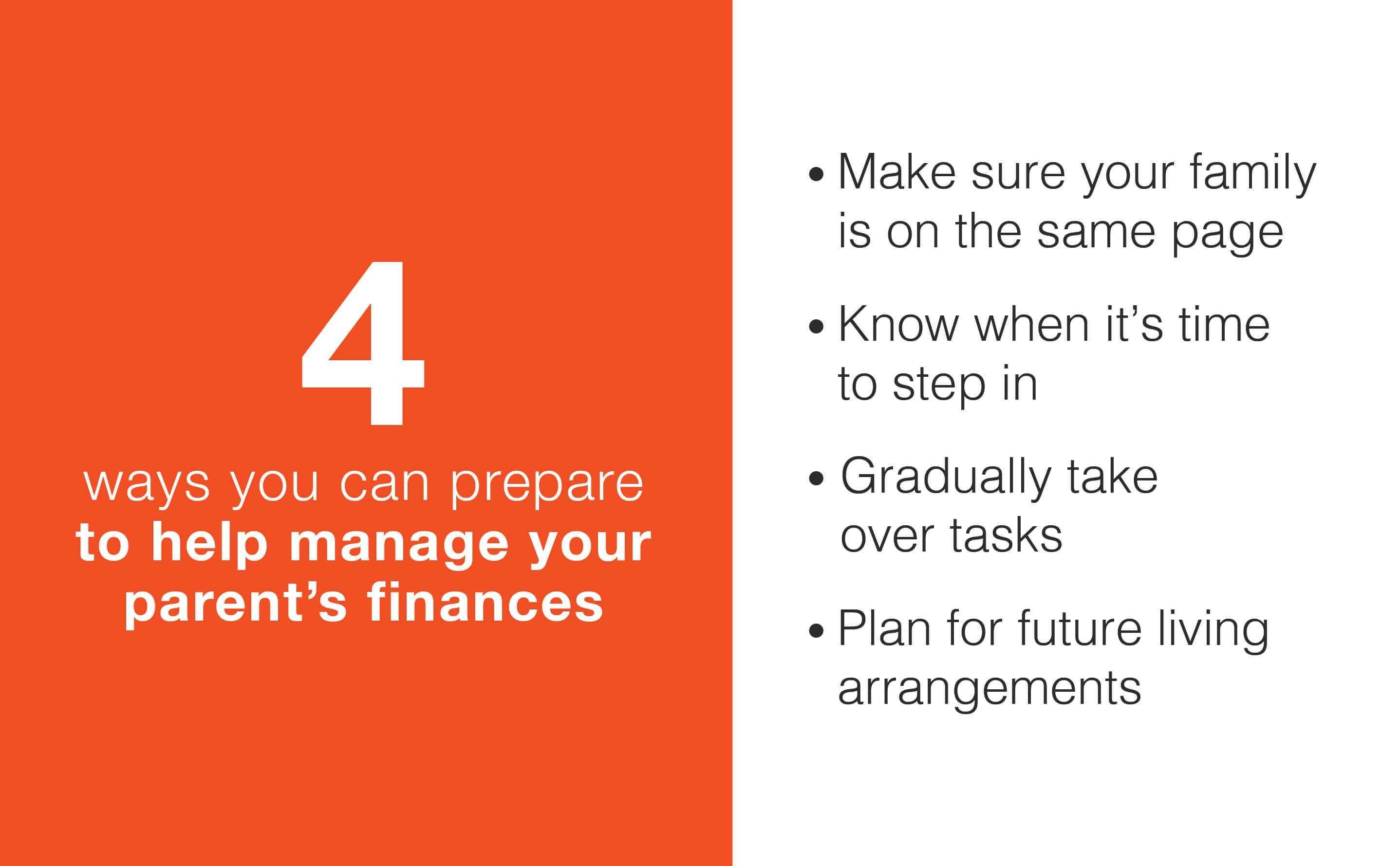

With rising dementia rates and a heightened threat of scams targeting the elderly, there are a number of situations that might prompt you to get involved with your parent’s finances. From paying routine bills and setting a monthly budget, it’s best to be prepared - and allowed - to step in. Here are some tips for helping with your parent’s finances:

- Make sure everyone is on the same page: In advance of the time when your parents will need your help, start having conversations with them and anyone else who is helping to plan for the future and the ways in which you’ll be helping with finances. It’s also best to get written consent (and eventually a power of attorney) for you to discuss your parent’s finances with financial, retirement, and healthcare professionals as needed. It may be a tricky conversation to have at first as your parents might not be ready to acknowledge they will need help, but the earlier these plans are in place, the better.

- Know when to step in: It can be hard to know exactly when your parents will need help, and what kind of help they will need exactly. Usually physical or cognitive health decline signals the need to step in, so be aware of warning signs like notable memory loss, unusual spending habits, an increased tendency to fall for scams, or other age-related disabilities.

- Gradually take over tasks: Once your family is on the same page and you have permission to access your parent’s account numbers and relevant legal documentation, it’s good to gradually take over financial responsibility. This can start with setting up automatic bill payments for your parents, switching their retirement income to direct deposit, and helping them track their spending. Ongoing communication and transparency during this process is critical to maintaining trust within your family.

- Plan for future living arrangements: One of the biggest costs for elderly people is the need for assisted living arrangements. With rising demands and costs, it’s extra important to plan ahead for scenarios in which your parents will need to move or adjust their living situation. Understand the costs and implications of the different levels of care to help ensure as smooth of a transition as possible.

Plan for change

When it comes to managing your parent’s finances, having important conversations and planning ahead of time go a long way in making for a smooth transition. For more information, check out the library of resources offered by the National Institute on Aging.