How can you increase your tax return?

The information contained in this blog is general in nature and should not be considered as legal, tax, accounting, consulting or any other professional advice. In all cases, please consult with professional advisors familiar with your particular tax situation before making any decisions.

Tax season is a time where individuals and businesses prepare and file their annual income taxes. Claiming tax deductions can help ensure that more money stays in your wallet, lowering your owed taxes and even increasing your tax return.

Through traditional tax deductions available, a filer may be able to reduce their overall taxable income prior to applying their tax bracket.

Standard deduction

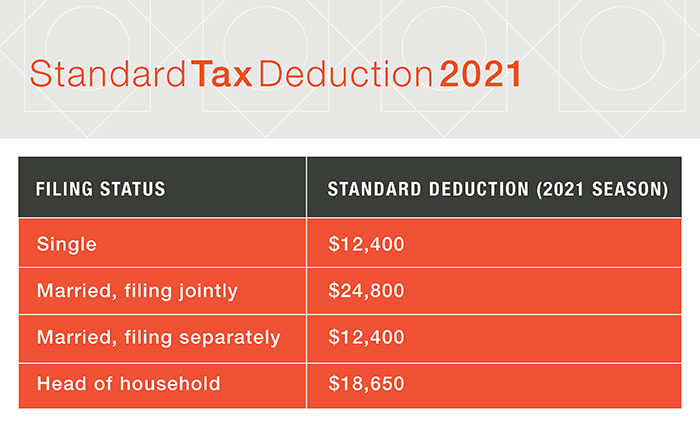

Reducing your taxable income, the standard deduction conveniently utilizes a set and specific dollar amount based on your filing status. However, this particular deduction does not take into account specific items, like charitable donations, mortgage interest, or medical expenses. Instead, it serves as a standardized deduction rate, regardless of those items. This can work in your favor if the benefits of the standard deduction outweigh those of an itemized deduction, which cannot both be filed.

The chart below provides an overview for the standard deduction this tax season.

Itemized deduction

Extending beyond the standard deduction, itemized deductions take into consideration expenses, like mortgage interest or charitable donations. Itemized deductions operate similarly to the standard deduction, with below-the-line deductions (lowering adjusted gross income), however they have specific requirements that incentivize certain financial actions and qualify you for the deduction. Filing taxes in this way requires significantly more documentation throughout the year, but it could get you deductions beyond the standard.

Schedule A from the IRS provides a full breakdown of potential itemized deductions, but the list below gives you an idea of the itemized deductions available to you.

- Interest expenses

- Home mortgage interest

- Charitable donations

- Unreimbursed medical and dental expenses

- Casualty and theft losses

- Job-related expenses

Above-the-line deduction

Available to you regardless of selecting the standard deduction or itemized deduction, above-the-line deductions are subtracted from gross income in order to reach your adjusted gross income. The most common above-the-line deductions include, but are not limited to alimony, educator expenses, student loan interest, and IRA contributions.

Understanding gross income vs. adjusted gross income

Gross income is calculated by adding up your income throughout the year as documented on forms like W-2s, capital gains, etc. To get your adjusted gross income, simply subtract above-the-line deductions from your gross income.

Your strategic financial partner

Beyond tax season, our team of bankers is here to offer true and convenient solutions to help you grow throughout the year. With expertise and guidance, we will forge a path forward. Learn more.