Considering taking out a business loan? Here’s what you need to know

A great business plan without funding is nothing more than a plan. Every successful business out there - large or small - needed ample funding from someone or somewhere to get off the ground, sustain through uncertain times, or grow to the size it’s reached today.

If you have the goal of starting your own business, or implementing a significant expansion to your existing business, you’ve probably considered taking out a loan. But as many business owners can attest, the financing process can be confusing and daunting.

Let’s take a look at the main steps involved in taking out a loan, as well as the key information you need to know along the way, to help demystify this process.

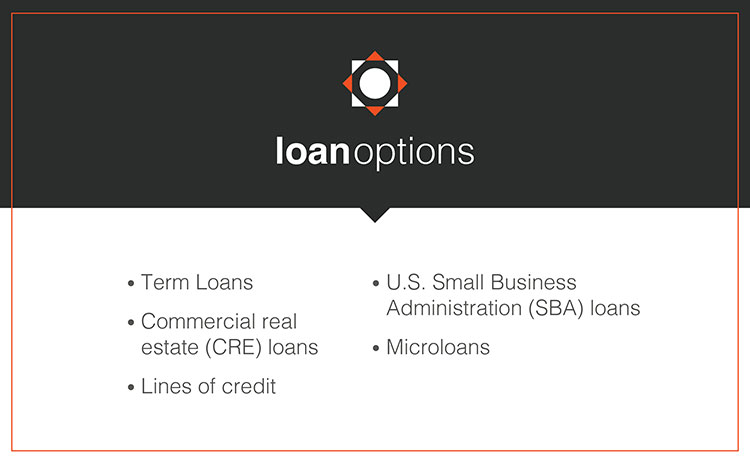

Know your loan options

Having a clear understanding of your business goals helps narrow down the financing option that’s right for you. There are a range of financing options available depending on what your business goals are, from startup funding to expansions and all the expenses in between, like real estate and equipment.

It can be harder to qualify for business loans if your business is an idea you want to make a reality. There are several ways to secure funding, from traditional business loans to crowdfunding, and our article on raising funds for your new business highlights a few of those options.

Once your business is up and running, you might be looking for ways to help cover day-to-day or operational expenses, such as bills, payroll, or facility maintenance. Or if you have a mature business, you may be looking at financing an expansion or acquisition. A few common loan options include:

- Term loans - can be short-term or long- term for a one-time specific project or purchase that will allow for access to capital. Unlike a credit card or line of credit, this will have fixed repayment schedule.

- Commercial real estate (CRE) loans - property purchases or improvements

- Acquisition financing - unique to the business situation, market, and the individual companies involved.

- Lines of credit - type of loans that allows access to funds you need up to a specific amount/limit, then repay, like a credit card. Unlike a term loan you only pay interest on what you use.

- U.S. Small Business Administration (SBA) loans - government backed business loans known for advantageous terms and low interest rates for eligible businesses.

- Microloans – access short term funding for operational expenses, cash flow management, or finance a one-time equipment purchase or expansion. Microloans are smaller than the average business loan size and have lower interest rates.

Choosing the right source often depends on what stage your business is at and your financial standing. Factors banks consider for a loan include, but are not limited to, your business cash flow, annual revenue, industry, and financial health which includes your payment history and credit scores. In addition to traditional bank financing, government programs (like the SBA loans we mentioned above, grants, and nonprofit microlenders), credit cards, and cash advances can offer an alternative funding source. It’s important to note, however, that these alternatives are not always the best financing source for long-term needs and typically only address short-term cash flow needs.

Prepare for your application

Once you have your business goals clearly defined and have identified the best source of funding, it’s time to apply. While the exact application requirements will vary somewhat depending on funding source, there are a few common things you’ll want to have ready.

First and foremost, you should be ready to describe your business and provide detailed information about it. This includes:

- Details that speak to the health of your business. Know your numbers, such as revenue, profits, cash flow, debt, and significant operating expenses.

- A description of your business plan, goals, and how exactly you intend to spend the money from the loan.

- Your financial, tax, and bank statements.

- An understanding of your ideal loan amount, what you can pay, and any collateral you can put up including real estate, equipment, and vehicles and an accurate valuation of them.

Investing in your business

Westfield Bank understands the importance of investing in your business, which is why we take pride in the competitive lending solutions we offer business owners. Our team is here to provide personalized guidance and help you find the lending solutions that are right for your business.